how to avoid paying nanny tax

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. 8 Ways to Avoid a Nanny Tax Nightmare.

The net is your nannys.

. Your kids are now in school so you dont need a full-time caregiver or. Complete some initial paperwork. You cant begin calculating payroll for your nanny without knowing how much in taxes to withhold.

No Matter The Complexity Of Your Tax Situation TurboTax Helps You File With Confidence. Do you have to claim nanny on taxes. President from Clinton to Trump.

Tips to avoid the nanny tax. Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live. Giving your nanny the wrong tax form.

What Can Happen if You Dont Pay Nanny Taxes. Fined for not paying unemployment taxes. In that case the nanny would need to complete a W-4 to allow the.

The parents do not have to. To do this youll need your nanny to fill. The parents do not have to withhold income tax from their nannys pay but may choose to do so if the nanny asks them to.

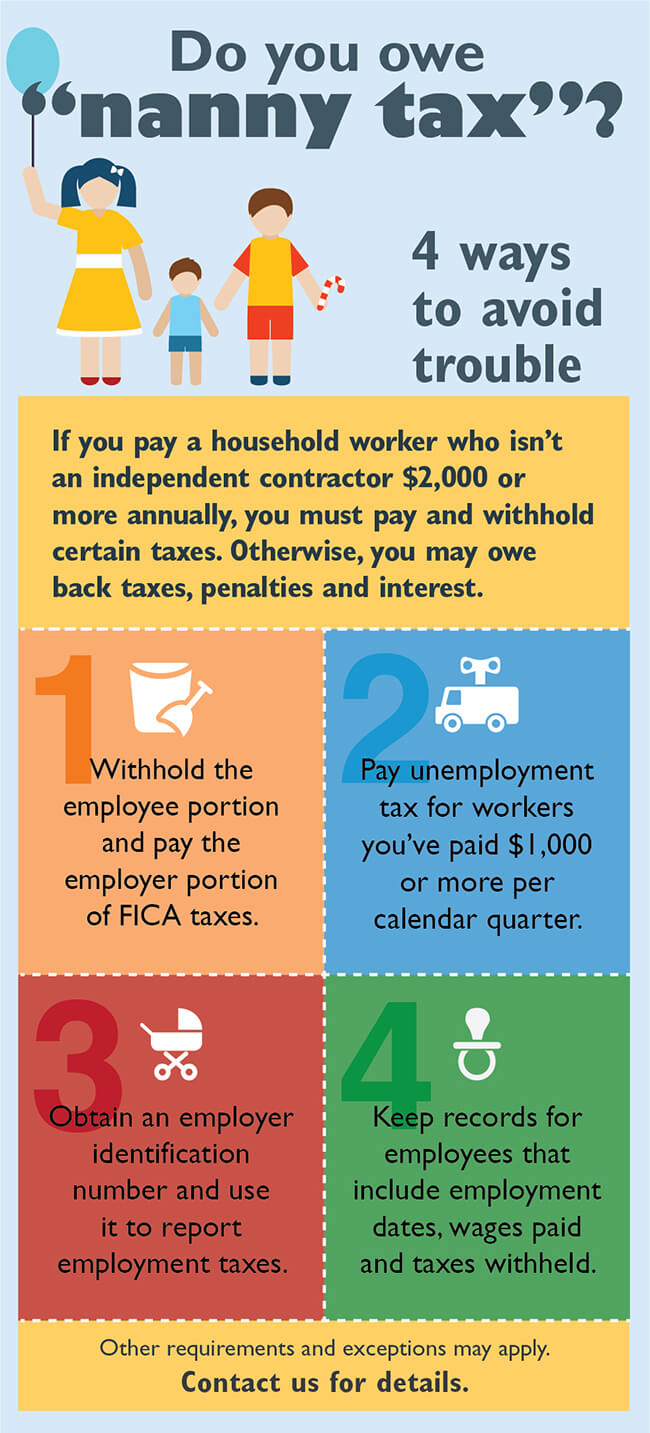

Avoiding The Nanny Tax Trap. The EIN will be used in your. If you paid a household employee for instance a nanny or a cook 2100 or more in cash wages in 2018 you must report and pay Social Security and Medicare taxes.

2-Pay your every other week maids no more than 5765 per home cleaning. Yes there are two tax breaks most people can take to offset the tax liability you incur by hiring a nanny. 5 ways to avoid nanny tax problems 1.

Employers are required to withhold social security and Medicare taxes if paying a nanny at least 2100 during a calendar year. Failure to pay the Nanny Tax has resulted in numerous high-profile scandals involving political appointees of every US. If youre a nanny you might want to pay your nanny tax in quarterly estimated payments as the year progresses or ask your own employer to increase your withholding to.

Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. You generally must pay. Nanny Household Tax and Payroll Service.

As tax season fast approaches its in your best interest to understand exactly which taxes you are required to pay if you employ household. Ad CareCom Homepay Can Handle Household Payroll And Nanny Tax Obligations. You can actually minimize the cost of your nanny tax if your employer offers a Flexible Spending Account a program that allows you to withhold pre-tax money from your.

Nanny Household Tax and Payroll Service. This ongoing parade of Nannygate. How to avoid the Nanny Tax.

Are there tax breaks to lower the cost of my nanny taxes. Meet the employment tax. Ad Learn How To File Taxes From A Live Tax Expert With TurboTax Live.

1-Pay your weekly maid no more than 2883 per house cleaning. The unemployment tax is paid only by the employer. Apply for an Employment Identification Number EIN with the IRS.

Its required if your total household salaries are 1000 or more in any calendar quarter. The unemployment tax is paid only by the employer.

6 Household Employment Mistakes And How To Avoid Them Care Com Homepay

Do You Owe Nanny Tax Yeo And Yeo

Staying On Top Of Nanny Tax In Ontario

3 Ways To Pay Nanny Taxes Wikihow

Payroll For Your Nanny Or Caregiver Getting Started Nannytax

How To Avoid The Nanny Tax Maid Service Faqs

How To Treat Your Nanny Domestic Employment Nannytax Canada

The Abcs Of Household Payroll Nanny Taxes Cpa Practice Advisor

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

Nanny Taxes Q A Who Owes Who Pays H R Block Newsroom

I Never Got Around To Paying My 2016 Nanny Taxes Is It Too Late

3 Ways To Pay Nanny Taxes Wikihow

The Differences Between A Nanny And A Babysitter

The Basics Of Household Payroll Nanny Taxes Tax Practice Advisor

3 Ways To Pay Nanny Taxes Wikihow

/Frame2167-cb5ec1e64a8f47e6a406dc0ee71ec3be.jpg)